PAN Card Photo (India)

It is difficult to get photos for the Indian PAN card application in the USA. None of the popular passport photo providers, including Walgreens, CVS, UPS stores offer PAN Card photos. We can help you with that, and also for India Visa, OCI, etc.,with our innovative online passport photo service, wherever you are in the USA or in any other country. We help customers with Pan Card photos in New York, Los Angeles,

Seattle, Houston, New Jersey, Chicago, or in any state like Texas, California,

Illinois, or Florida.

We have a simple process to take away all your worries regarding the PAN card application. Take a photo of yourself with any digital camera or a smartphone, and upload it on our website with your order.

Same day, or within a few hours, you will be able to pick up PAN photos at your nearby Walgreens, CVS, or Walmart store. Regarding acceptance of our photos, rest assured. We are #1 and we have helped thousands of Indian nationals with PAN card photos in the USA. Check Google for reviews about us and our service.

PAN Photo Specs

Printed PAN Card Photos

OnlinePassportPhoto.com is a leader in the Indian PAN Card (Permanent Account Number) photo in the USA. PAN Card photos, 35 x 25 mm, as they officially specify, are very different than the USA passport photo which is 2x2 inches in size (around 51x51mm). It is also very different than a passport photo for any other country.

Digital Image with Signature specs

You can now submit your application online for a PAN card. Applicants should have scanned images of photographs, signatures, and supporting documents i.e. Proof of Identity (POI) /Proof of Address (POA) /Proof of Date of Birth (PODB).You can order Digital images for your PAN Card with us, at this link:

https://onlinepassportphoto.com/Digital-image-package-order.htm

| Sr. No. | Parameters | Photograph | Signature | Supporting documents |

| 1. | Resolution (in DPI) | 200 DPI | 200 DPI | 200 DPI |

| 2. | Type | Color | Color | Black & White |

| 3. | File type | JPEG | JPEG | PDF/A or JPEG |

| 4. | Size | Max. 20 KB | Max. 10 KB | Max. 300KB/per page |

| 5. | Dimension | 3.5X2.5 cms. | 2X4.5 cms |

Customer Reviews about our PAN Card Photo service

Ashok May 15, 20XXWhen I asked about the PAN Card picture for India at Costco, I got stares back from the associate. I am glad that I found this service by chance while Googling the dimensions.

I ordered the prints very late in the evening ~ 9pm and picked them up from Walmart at 11am the next day. Service is great and I even got an honest suggestion to load a new digital image as the earlier one wasn't going to be good. The whole transaction was handled professionally and efficiently with quick email updates. Thanks a lot!

Bhavdeep Singh (Chicago, USA)

I ordered pictures for a PAN card. I am impressed by the quick, efficient, and quality service provided by onlinepassportphoto.com After I uploaded my pictures, they were edited and sent for printing in no time. I requested minor changes and they were made within minutes. I was also given a discount for multiple orders in the same transaction. I had used their service in the past for my family's OCI pictures. I will come back, for my future photo editing requirements. I will recommend this service. I can say, you will be happy with your decision.

Check Google for reviews for more reviews

PAN Card photo size: Not the same as the US passport photo!

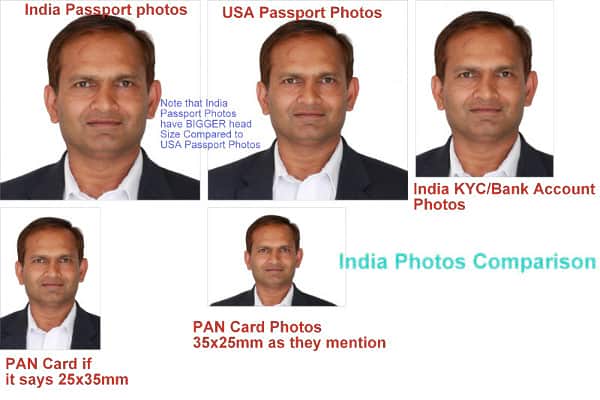

A PAN Card photo is materially different than the US passport photo that you get at Walgreens or CVS stores. US passport photo is 2x2 inches or 51 x51 mm in size. A PAN card photo is smaller in size- only 35 x25mm.You can compare a PAN card photo to various other India-related photos below:

PAN Card photo size debate- 35x25mm or 25x35mm?

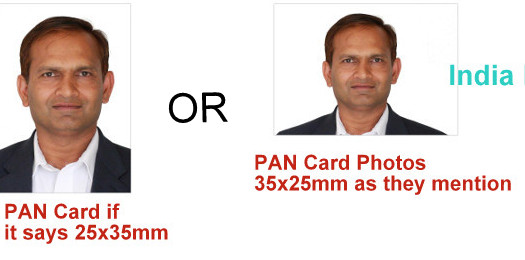

PAN Card form (Form 49A and 49AA ) instructions mention a 35x25 mm photo. As per passport photo convention, the first number is x - horizontal and the second number is y- like the y-axis - vertical. So not sure if the PAN card processing authority wants a wider photo- 35x25mm or if they mean a vertical photo. They mention 35 x25mm but the box on the PAN Card application form seems like they want a taller- 25x35mm photo. (Please note that the box on the form is not in exact size so neither of the 35x25 nor 25x35mm photos will exactly fit in the form!)

Now based on our experience with a few thousand PAN card photo customers, we can confirm that they accept photos in either size. We have made 35x25mm (wider) photos for many customers and 25x35mm (taller) photos for the majority of customers. So far, none of our customers have come back to us and reported any rejection of photos we have created for them with the reason for being in the wrong size.

DSC-based Online Application for New PAN (Form 49A)

Application for fresh allotment of PAN can be made through the Internet. Further, requests for changes or corrections in PAN data or requests for a reprint of a PAN card (for an existing PAN) may also be made through the Internet.

The online application by foreign nationals can be made here. For instructions, see https://www.protean-tinpan.com/services/pan/instructions49AA.html

Order your PAN card photos

PAN Card Photo Details

Please note that

(i) " The photo is to be like an Indian passport which shows up to

shoulders. The photo should show 50 to 60% covers the head portion and

the balance up to and below the shoulder line for acceptance It does not

matter if the photo is slightly bigger."

(ii) the

photos submitted by PAN Card applicants are scanned by NSDL in India.

For scanning photos, it helps if the PAN Card photo is taken in good light and has enough contrast.

(iii) In the specs they mention a white background, but some customers

have reported that the NSDL scanning prefers a slightly blue/very light

blue background so unless you specify, we may create photos on a very

light blue background if there is not enough contrast in the original photo.

How To Take Photos at Home For PAN Card:

First, make sure the photo you send us meets the following requirements:- Full UPPER HALF BODY view with all facial features visible.

- The face should neither be too bright nor too dark

- If wearing spectacles - a reflection of light from the glasses should not be visible.

- White or near-white background with no visible shadow on the face or background.

- Do not wear a white/ light-colored shirt as it blends with a light background.

- Light reflection from

hair should not be visible.

Important Info about PAN Card:

Detailed step-by-step information: Online Application for Request for New PAN Card Or/ And Changes Or Correction in PAN DataQUICK FAQ:

Everything you need to know about PAN photos—exact size, background, digital specs, and how to apply online.

1) What is a PAN card?

A PAN (Permanent Account Number) is a unique ten‑character alphanumeric ID issued by India’s Income Tax Department. It is used for income‑tax compliance and high‑value financial transactions.

2) Who needs a PAN?

- Individuals and businesses who file tax returns or are required to furnish returns.

- Anyone entering financial transactions where quoting PAN is mandatory (as notified by the CBDT).

3) PAN card photo size & requirements

- Photo size: 25×35 mm (3.5×2.5 cm).

- Background: Plain white or very light background.

- Pose: Neutral expression, eyes open, full face visible; remove hats/tinted glasses.

- Lighting: Even, front‑facing light; avoid shadows on the face and background.

Note: Always follow the current instructions shown on the official application portal. Requirements can vary by issuer and form version.

Recommended digital specs

- JPEG at ~300 dpi with a pixel size around 295×413 (corresponds to 25×35 mm).

- Keep file size within the limits shown on the portal during upload.

- Crop to include shoulders and chest; keep head centered and straight.

4) How to take a PAN card photo at home (fast checklist)

- Use a plain white wall or hang a white sheet.

- Stand ~4–6 ft from the camera; keep the camera at eye level.

- Use bright, even lighting (window light or two lamps at 45° angles).

- Relax your face; keep a neutral expression; look at the camera.

- Take a few shots; pick the sharpest one without shadows.

5) How to apply for a PAN card online

Use Form 49A (resident Indians) or Form 49AA (non‑residents/foreign nationals) on the official portals. Complete the form, upload your photo and signature as required, pay the fee, and track your application status.

6) Let us format your PAN photo

- Background cleanup, exposure fix, and compliant 25×35 mm cropping.

- Digital file for online upload, or a 4×6 print sheet for local same‑day pickup.

- Fast turnaround and friendly support.

Top Links

Services

About Us

All content on this website is protected by copyright act. Online Passport Photo services have patents.

COPYRIGHT © 2020 by OnlinePassportphoto.com

For Privacy Policy, click here